FEATURED

How To Perform Wage-and-Hour Audits

With a wage-and-hour audit, you can ensure your company is in legal compliance. During a full wage-and-hour audit, you’ll look at your company’s employee classifications, overtime pay, minimum wage, and compliance history. While the U.S. Department of Labor handles...

How To Perform Wage-and-Hour Audits

With a wage-and-hour audit, you can ensure your company is in legal compliance. During a full wage-and-hour audit, you’ll look at your company’s employee classifications, overtime pay, minimum wage, and compliance history. While the U.S. Department of Labor handles...

TRENDING

HR Compliance Update | March 12, 2025

FEDERAL UPDATES OFCCP Workforce Reduction – Reports of a memorandum from OFCCP’s acting director suggest that the agency will lay off 90% of its workforce and reduce its offices from 55 to 4. It intends to retain a limited number of staff to review contractors for...

Fostering Connection in the Virtual Workspace: Strategies for Team Bonding

The era of remote work has ushered in a new set of challenges for businesses. Among them is the need to nurture team bonds and social connections in a digital environment. A pioneer in behavioral science, offers valuable insights and techniques to address this crucial...

Cement Manufacturer Faces $62,500 in OSHA Penalties After Employee Death

In a heartbreaking incident that underscores the paramount importance of workplace safety, a recent federal investigation has unveiled a preventable tragedy that occurred at a leading cement manufacturer. The U.S. Department of Labor's Occupational Safety and Health...

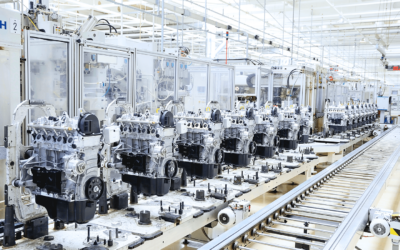

Manufacturer Fined $298,000 in OSHA Penalties: What Small Businesses Need to Know

Ensuring a safe and compliant workplace is of paramount importance for every business, regardless of size or industry. The U.S. Department of Labor (DOL) recently highlighted the consequences of failing to address safety hazards within the workplace. An engine...

DOL Investigation of Tech Consulting Business Leads to a $46,731 Fine for 401(k) Contribution Violations

The U.S. Department of Labor (DOL) has taken legal action against a technology consulting company based in Minnesota, shedding light on the critical importance of remitting employee retirement plan contributions as required by law. The DOL filed a lawsuit on August...

DOL Demands $174,751 in Back Wages from Home Healthcare Business for 50 Caregivers

In a recent case, the DOL successfully recovered $174,751 in back wages for 50 caregivers working for a home healthcare business. The violation in question involved the failure to pay overtime to these workers, underscoring the importance of compliance with employment...

How Different Sectors Approach 401(k) Retirement Planning

Retirement planning, while universally essential, manifests differently across diverse industries. Each sector, influenced by its unique challenges and opportunities, molds a distinct approach to 401(k) plans. This comprehensive exploration dives deeper into the...

EEOC Sues Hotel and Casino Owner for Sexual Harassment: What Business Owners Should Know

Small and midsize business owners should be keenly aware of the legal and financial consequences associated with failing to prevent and address sexual harassment in the workplace. A recent lawsuit filed by the U.S. Equal Employment Opportunity Commission (EEOC)...

DOL Fines Local Restaurant Owners $220,080 in Back Wages and Damages

In recent years, the U.S. Department of Labor (DOL) has been actively enforcing employment laws to ensure fair treatment of employees. One notable case involved a Maine bar and grill where 36 workers were not paid their wages properly, overtime was avoided through...

Challenge Everything: Fostering a Culture of Curiosity and Excellence

In the realm of organizational success, there's an often-overlooked rule that holds tremendous transformative power: "Challenge Everything." This rule may appear daunting, especially when applied to employees at various levels within an organization. However,...

Navigating the New Normal: Rethinking Management and Team Dynamics in the Virtual World

The shift towards remote work has brought about a fundamental change in the way businesses operate. Entrepreneurs, business owners, and managers are now faced with the challenge of adapting to this new normal. It's crucial to understand that transitioning to a virtual...

DOL Investigation Recovers $419,615 in Unpaid Wages and Damages for 21 Workers of Grocery Wholesaler

A recent federal investigation has shed light on employment violations at a grocery wholesaler, emphasizing the importance of adhering to labor laws and ensuring fair compensation for workers. A grocery wholesaler, has been ordered by the U.S. Department of Labor...

Higher Enforcement Activity Expected After DOL-EEOC Partnership Agreement

By Michael H. Neifach & Thomas L. Petriccione with Jackson Lewis P.C. Body The Department of Labor (DOL) and the Equal Employment Opportunity Commission (EEOC) have announced they will be collaborating and sharing information to improve their enforcement efforts....

DOL Recovers $153,768 in Retirement Funds for 4 Employees of Environmental Company

A recent legal development highlights the importance for all businesses, particularly small and midsize enterprises, to prioritize compliance with retirement fund regulations and employee benefits. The U.S. Department of Labor (DOL) has secured a default judgment to...

DOL Sues Pipe Company for Firing Whistleblower: What Small Businesses Can Learn

In a recent case, the U.S. Department of Labor (DOL) has highlighted the importance of adhering to federal employment laws, particularly focusing on whistleblower protections. The DOL initiated a lawsuit against a pipe company, accusing the manufacturer of violating...

$545,853 in Penalties for Tile Manufacturer After DOL Investigation

An Ohio-based vinyl tile manufacturer, is under scrutiny once again for its repeated failure to ensure the safety of its workers. This recent episode has resulted in a staggering $545,853 in federal penalties after investigations by the U.S. Department of Labor...

DOL Investigation Recovers $215,000 in Back Wages and Penalties for Restaurant Operators

In a stern warning to small and midsize business owners, a recent U.S. Department of Labor (DOL) investigation in New Hampshire has resulted in the recovery of $215,675 in back wages and liquidated damages for 47 workers who were denied overtime pay and subjected to...

Contractor Faces Manslaughter Charge and $449,583 in OSHA Penalties After Failing to Protect Employees

A tragic incident in 2021 highlights the critical need for businesses, especially small and midsize contractors, to prioritize workplace safety and adhere to federal regulations. The case involves a trench collapse that resulted in the death of a 23-year-old worker,...

EEOC Files Multiple Lawsuits Against Restaurant Managers for Sexual Harassment and Discrimination

Small and midsize business owners need to be acutely aware of the significant consequences associated with workplace harassment and discrimination. The U.S. Equal Employment Opportunity Commission (EEOC) recently filed two separate lawsuits against a restaurant and...

Construction Contractor Fined $262,977 for OSHA Violations

A recent federal workplace safety investigation has brought to light alarming safety violations by a Texas-based contractor, shedding light on the critical importance of adhering to safety protocols to prevent tragic accidents in the workplace. Asure’s HR experts...

DOL Recovers $540,221 in FLSA Penalties from Farm Labor Contractors

In a recent revelation, the U.S. Department of Labor (DOL) has successfully recovered $540,221 in wages for 268 H-2A workers from a father and son, operating as North Carolina farm labor contractors. The violations by the farm labor contractors included failing to pay...

Unlock your growth potential

Talk with one of experts to explore how Asure can help you reduce administrative burdens and focus on growth.