FEATURED

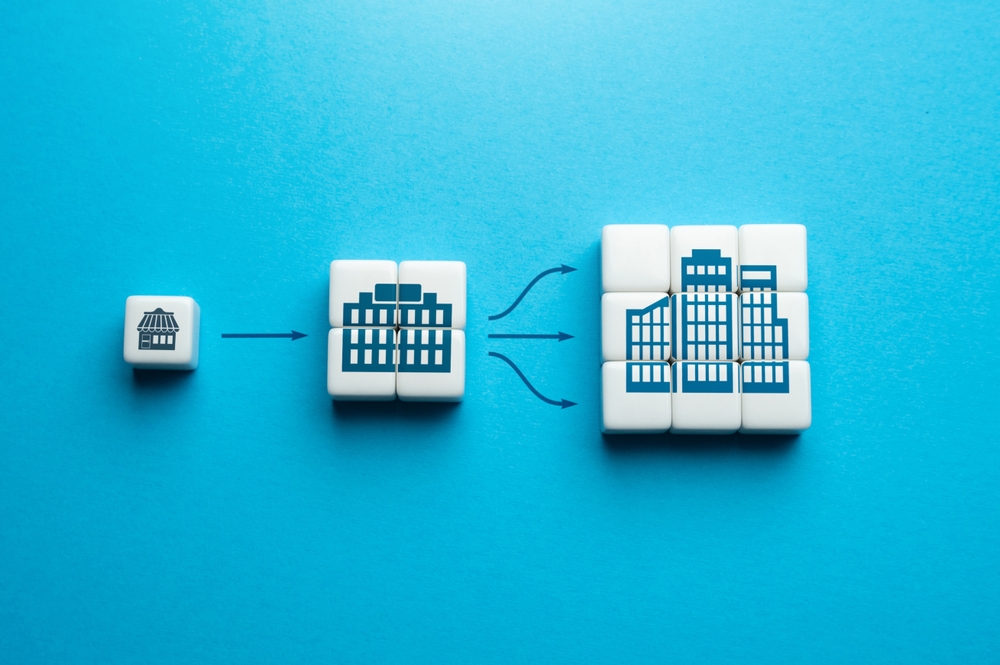

Scaling Payroll Tax Compliance as Your Business Grows

When you leverage advanced payroll technology, you can scale your company’s payroll tax compliance with ease. As a large business, you must follow state, federal, and local tax codes. Once you start adding extra employees and expanding into new jurisdictions, the...

Scaling Payroll Tax Compliance as Your Business Grows

When you leverage advanced payroll technology, you can scale your company’s payroll tax compliance with ease. As a large business, you must follow state, federal, and local tax codes. Once you start adding extra employees and expanding into new jurisdictions, the...

TRENDING

The Hidden Costs of Financial Stress in the Workplace—And How Earned Wage Access Helps

Why supporting employee financial wellness isn’t just good for people—it’s good for business. Financial stress is no longer a personal issue—it’s a workplace issue. When employees are worried about money, it impacts more than their peace of mind. It affects your...

Maximizing Productivity with Chat GPT: Practical Tips for Busy Small Business Owners

In today's fast-paced business landscape, small business owners often find themselves juggling multiple responsibilities and facing time constraints. Adopting AI technologies like Chat GPT can significantly enhance productivity and streamline...

$25,500 Penalty for Business with Illegal Job Posting – DOJ

As a small or midsize business owner, it is crucial to understand and comply with employment laws to protect your business from penalties and legal repercussions. A recent settlement agreement between the Justice Department and an IT recruiting and contracting company...

Guide to FLSA Overtime Rules

“Hey Pam, I have you on the schedule for 42 hours this week but just 30 next week. Can you just clock 32 next week and 40 this week?” “This training doesn’t count as work hours since we don’t have customers then.” “Bob, you receive a set salary of $500 a...

Overtime Violation: $7 Million in Back Wages & Penalties From Home Care Provider

As a small or midsize business owner, it is crucial to be aware of the potential penalties for violating employment laws. A recent case serves as a stark reminder of the consequences that can be incurred. A local provider of home care services, and its owner, have...

Employee Classification Types: Comparing Pros and Cons

“The competition to hire the best will increase in the years ahead. Companies that give extra flexibility to their employees will have the edge in this area.” - Bill Gates, Founder of Microsoft. When classifying workers, consider what’s best for growing...

Join the Movement: 7 Ways Businesses Can Participate in PTSD Awareness Day

PTSD Awareness Day, also known as Post-Traumatic Stress Disorder Awareness Day, is an observance held annually on June 27th. The day is meant to raise awareness about PTSD and its effects on individuals, families, and communities. There are currently about 12 million...

Washington State to Bar Employers From Relying on Off-Duty Use of Marijuana in Hiring Decisions

By Kathryn J. Russo and Sherry L. Talton with Jackson Lewis P.C. The state of Washington will prohibit employers from making hiring decisions based on off-duty use of cannabis or positive pre-employment drug test results that find an applicant to have Non...

New York City Enacts Legislation Prohibiting Discrimination Based on Height, Weight

By Richard I. Greenberg, Daniel J. Jacobs, Henry S. Shapiro and Jack B. Greenhouse with Jackson Lewis P.C. New York City Mayor Eric Adams has signed legislation amending the New York City Human Rights Law to prohibit discrimination based on a person’s...

The Intersection of Employee and Employer Benefits

In the realm of talent acquisition and retention, employee benefits play a crucial role. While commonly discussed as separate entities, it is essential to acknowledge the intrinsic connection between employee and employer benefits. A prime example is On-Demand Pay....

Gaining a Competitive Edge: The Benefits of On-Demand Pay for Employers

In today's competitive business landscape, employers are constantly seeking ways to stand out and attract the best talent. One powerful tool that can give them a significant advantage is offering On-Demand Pay. Let's explore the competitive advantages...

The Power of Earned Wage Access: Boosting Employee Well-being and Empowering Employers

Financial stress can take a toll on employees, affecting their overall well-being and job performance. However, the introduction of earned wage access (EWA) has emerged as a game-changer. With the ability to access a portion of...

Restaurant Forced to Pay $60,065: How to Avoid DOL Violations and Penalties

As small and midsize business owners, it is crucial to understand and uphold the rights of your employees. A recent case investigated by the U.S. Department of Labor serves as a reminder of the consequences faced by employers who violate the Family and Medical Leave...

How to Classify Exempt Employees Vs. Non-Exempt Employees

Don’t get this wrong. It’s one of the most common payroll mistakes. And it’s costly. Determining whether an employee is exempt or non-exempt is a crucial aspect of compliance with labor laws. The classification of employees as exempt or non-exempt has significant...

$1.6 Million in Penalties Issued by DOJ to Business Owners for Illegal Job Postings

As a small or midsize business owner, it is crucial to understand and comply with employment laws to avoid costly penalties and legal issues. Recently, the U.S. Justice Department has taken significant actions against employers who have posted discriminatory job...

Yes, You Can Still Get ERTC Money for Your Business

With the threat of an unprecedented U.S. government default, business owners were understandably concerned that ERTC (the Employee Retention Tax Credit) would end. However, with the signing of The Fiscal Responsibility Act of 2023 into law, businesses can be reassured...

$71,182 in Penalties: DOL Busts Franchise Operator for Illegal Employment of Teenagers

The recent case of a company, operating as fast food franchise, in Nevada, has shed light on the importance of business owners adhering to child labor laws. The U.S. Department of Labor's (DOL) investigation revealed more than 170 violations of child labor provisions,...

Payday Loans vs. Earned Wage Access: Understanding the Key Differences

The financial landscape is constantly evolving, and one significant shift in recent years has been the rise of earned wage access as an alternative to traditional payday loans. In this article, we will delve into the differences between payday loans and earned...

The Demise of Payday Loans: The Technological Evolution of On-Demand Pay

The world of payday loans has long been associated with predatory pricing strategies that exploit individuals in dire need of financial assistance. The sight of same-day loan signs flashing along the roadside has become all too familiar, signifying the...

$181,561 Penalty for Misclassification of Employees – DOL

As small and midsize business owners, it is crucial to be aware of the legal implications and penalties associated with employee misclassification. A recent investigation by the U.S. Department of Labor highlights the consequences faced by a federal contractor who...

The Rise of On-Demand Pay: Empowering the Workforce with Earned Wage Access

In recent years, a significant shift has been observed in how people receive their pay. Traditional payroll cycles with bi-weekly or monthly payments are giving way to a new trend known as on-demand pay or earned wage access. This transformative concept enables...

Unlock your growth potential

Talk with one of experts to explore how Asure can help you reduce administrative burdens and focus on growth.