Oct 30, 2023 | Compliance

By Michael H. Neifach & Thomas L. Petriccione with Jackson Lewis P.C. Body The Department of Labor (DOL) and the Equal Employment Opportunity Commission (EEOC) have announced they will be collaborating and sharing information to improve their enforcement efforts....

Oct 30, 2023 | Compliance

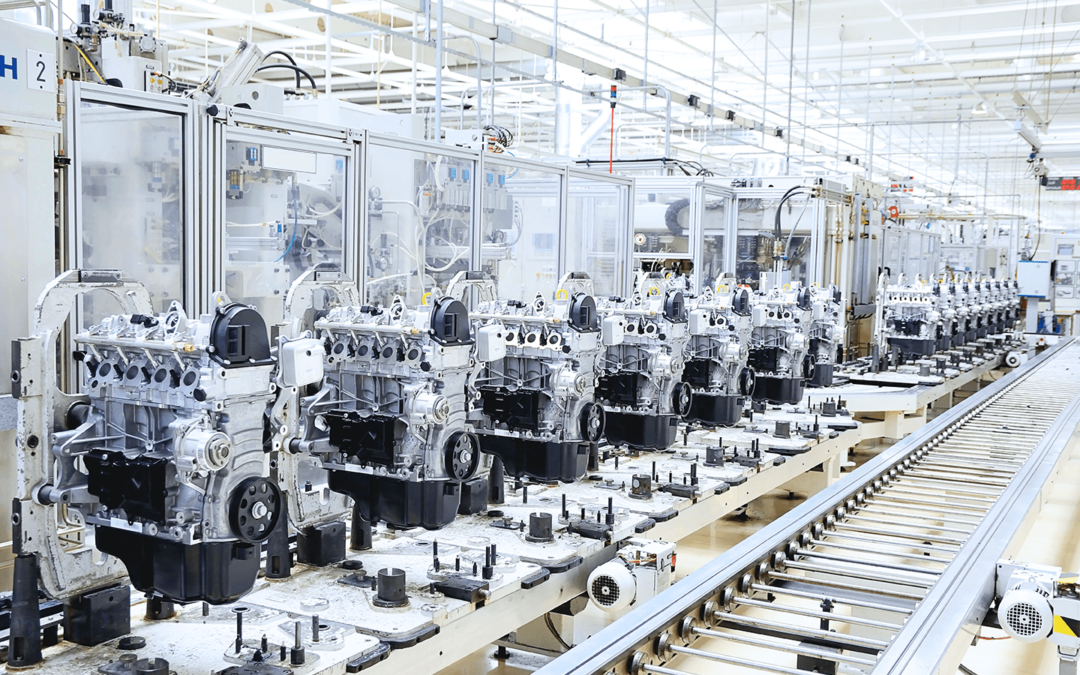

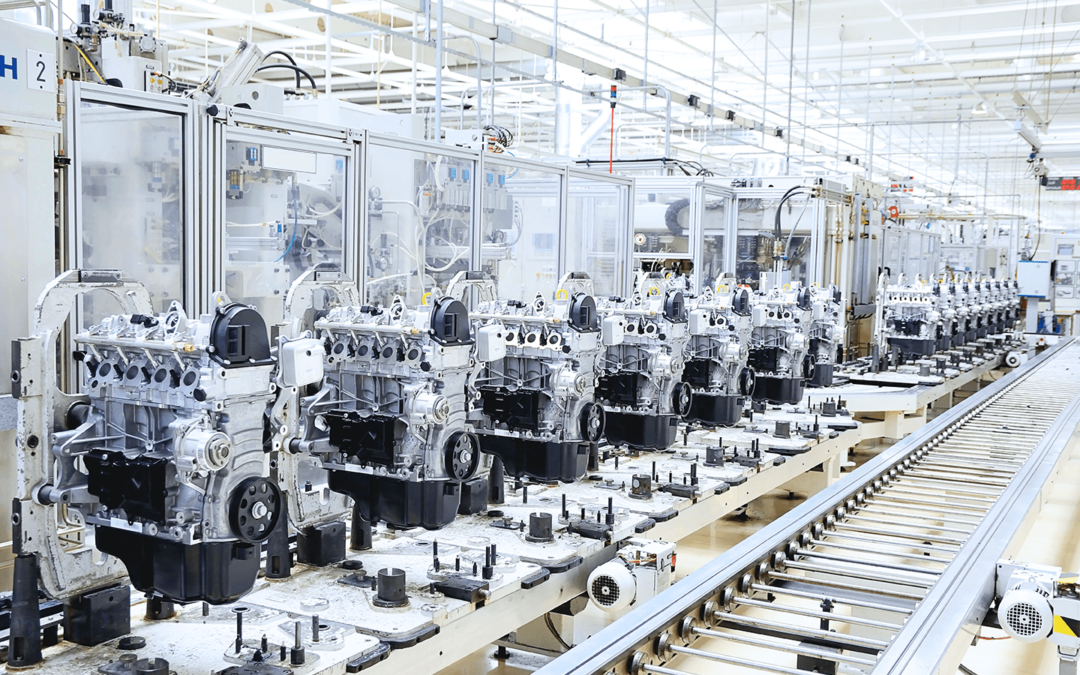

Ensuring a safe and compliant workplace is of paramount importance for every business, regardless of size or industry. The U.S. Department of Labor (DOL) recently highlighted the consequences of failing to address safety hazards within the workplace. An engine...

Oct 30, 2023 | Compliance

A recent legal development highlights the importance for all businesses, particularly small and midsize enterprises, to prioritize compliance with retirement fund regulations and employee benefits. The U.S. Department of Labor (DOL) has secured a default judgment to...

Oct 29, 2023 | Compliance

The U.S. Department of Labor (DOL) has taken legal action against a technology consulting company based in Minnesota, shedding light on the critical importance of remitting employee retirement plan contributions as required by law. The DOL filed a lawsuit on August...

Oct 28, 2023 | Compliance

In a recent case, the U.S. Department of Labor (DOL) has highlighted the importance of adhering to federal employment laws, particularly focusing on whistleblower protections. The DOL initiated a lawsuit against a pipe company, accusing the manufacturer of violating...

Oct 27, 2023 | Compliance

In a recent case, the DOL successfully recovered $174,751 in back wages for 50 caregivers working for a home healthcare business. The violation in question involved the failure to pay overtime to these workers, underscoring the importance of compliance with employment...