Why do small business struggle to get funding?

Many small businesses turn to their local banks to seek funding. The harsh reality is that these banks rarely approve loans for small businesses. In fact, less than 20% of small business loans are approved at local banks, which means more than 80% of business owners are declined the funds they need to help their business grow.

There is a better way.

Asure has partnered with Lendio, a proven provider with more than a decade of experience in helping small business owners access to the capital you need to support your growth journey.

The average small business owner spends 26 hours approaching 3 lenders.

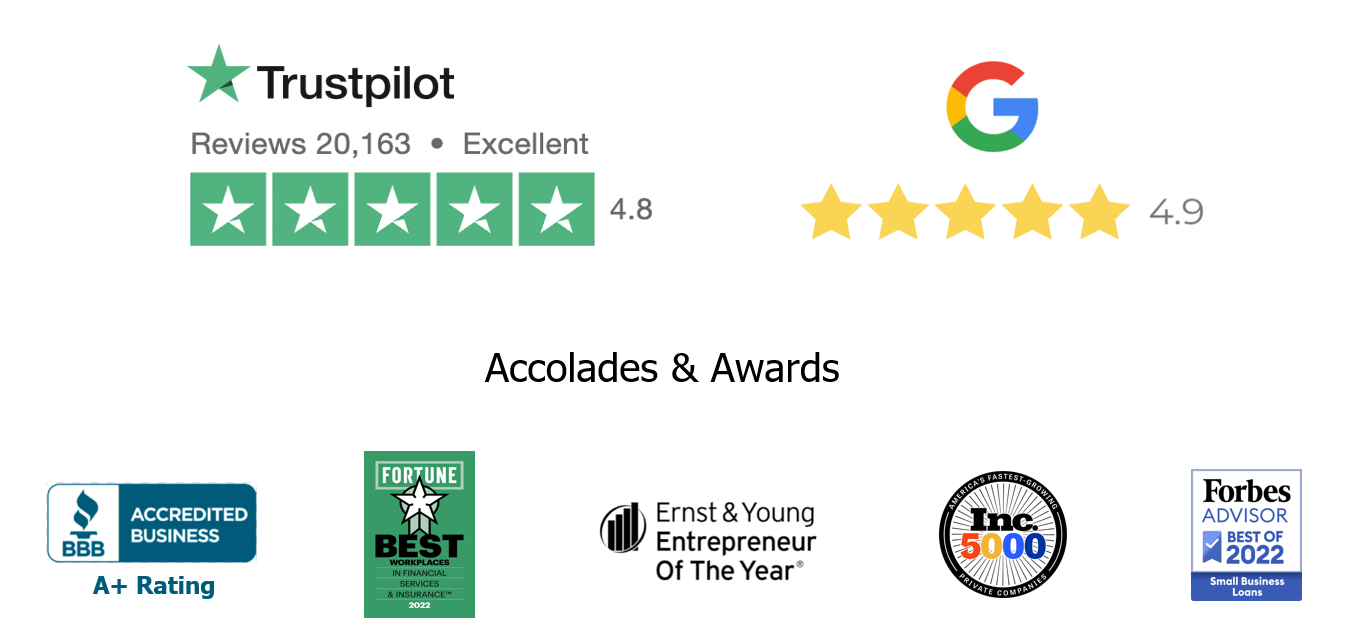

Who is Lendio?

Lendio is the nation’s leading small business financial solutions provider, with a mission to help small businesses survive and thrive. With its diverse network of lenders, Lendio enables small business owners to apply for multiple business financing options with a single application.

What Can You Expect with Lendio?

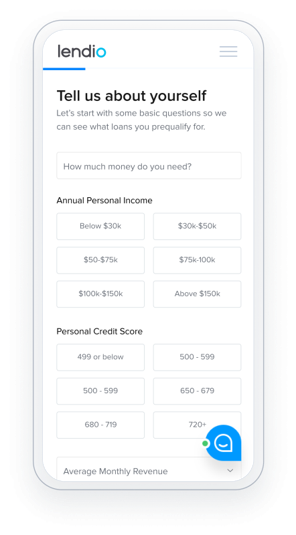

One FREE Application

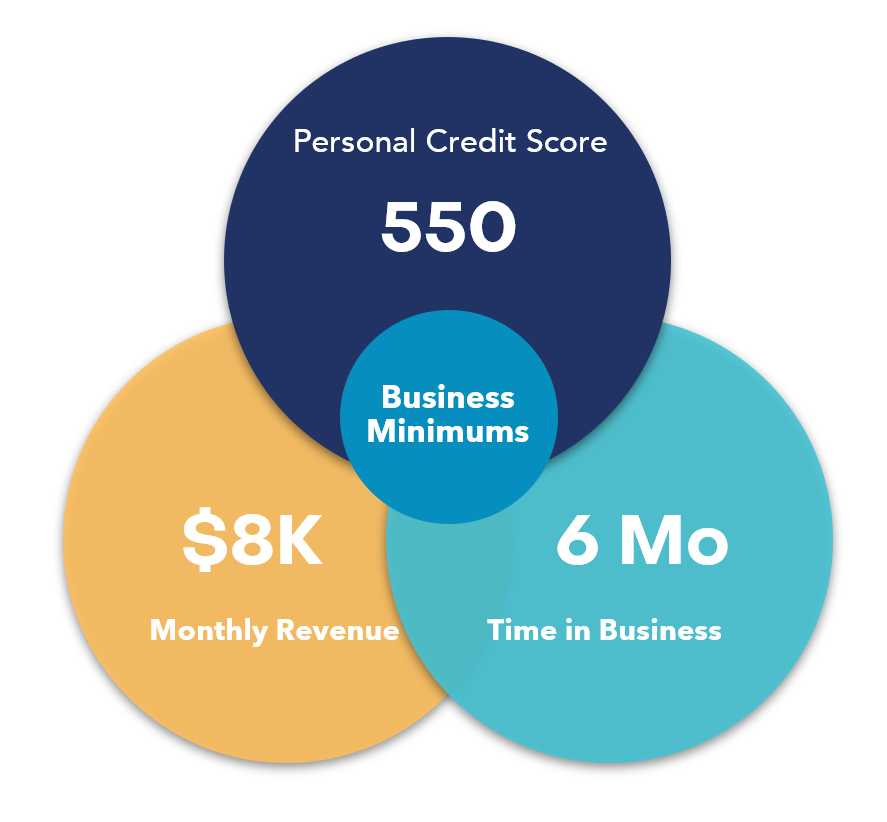

With Lendio, you complete a single, streamlined application that lets lenders know what type of funds you’re looking for.

Offers From 75 Lenders

Lendio’s sophistciated borrower matching algorithm connects you with lenders who can meet your needs.

Funding Specialist Support

Every business is unique. With up to 15 loan products to choose from, Lendio’s funding speciliast will help you select the loan type that’s right for your business.

Streamlined Lending Process

Step 1. Fill out our simple application.

Answer just a few questions about your business to see which lending products you qualify for. Lendio has partnered with over 75 lenders, so you can find the best option for your small business.

Step 2. Get connected with a funding specialist.

One of Lendio’s funding specialists will reach out to you to get to know your business better. Since every business is unique, it’s important to find the loan type that’s perfect for your needs.

Step 3. Compare loan offers.

Compare different offers curated for your business. Select the capital amount and rate that will help you take your business to the next level.

Step 4. Get funded.

Lendio works with lenders that expedite funding, so you can focus on growth, faster.

Unlock your growth potential

Talk with one of our experts to explore how Asure can help you reduce administrative burdens and focus on growth.