Inflation has been making headlines all summer, sparked by rising prices and increases in other key indicators. According to July 2021 data from the Bureau of Labor Statistics, the Consumer Price Index rose 5.4% year-over-year as of July 2021, representing the biggest jump since August 2008. Additionally, producer prices were 8.3% higher in August than one year ago.

Even though the average hourly wage grew 3.6% since last year, inflation essentially provided the average worker a 2% pay cut.

Current economic conditions leave us all to wonder: Is rising inflation here to stay? How will inflation affect wages and compensation? How will inflation affect overall talent recruitment, management, and retention?

Though the average compensation package has already increased this year, many believe that the recent spike in prices will drive salaries and hourly wages even higher next year. That means businesses need to be prepared to increase budgets for compensation and benefits. Economists are split on whether this will be a short-term blip in inflation or persist long-term.

What’s going on with inflation?

Inflation refers to the average rate of change in the prices of goods and services. Right now, we are dealing with big price spikes in used cars and gas but lower spikes in food. Some economists argue that inflation ticked up in recent months due to “transitory factors” and that these price increases can be traced to supply shortages resulting from the COVID-19 pandemic.

However, other economists say there are many other factors contributing to the rise in inflation. These factors include:

-

Low interest rates – prior to 2000, the Federal Reserve kept the key rate around 5%. However, 9/11, the 2008 financial crisis, and the onset of the 2020 COVID-19 pandemic have kept rates closer to 0.

-

High and fluctuating demand for goods. The pandemic has created unprecedented disruption to the production of goods as manufacturers faced transportation bottlenecks, rolling lockdowns around the globe affecting labor and materials, and surges in consumer demand for items like masks and cleaning products.

-

Heavy government spending and pandemic relief. The US government committed over $5.2 trillion to pandemic relief including unemployment benefits which has exacerbated labor shortages.

Strategies to help businesses cope with rising prices and wages

As your business navigates the hurdles of supply chain disruptions, labor shortages, and higher prices for raw materials, there are several things you can do to ensure success through this difficult inflationary period. Though you may need to raise prices to make up for the increased labor and materials costs, it’s critical that you address other areas of your business including cash reserves, financial reporting and early warning systems, and supplier and customer relationships.

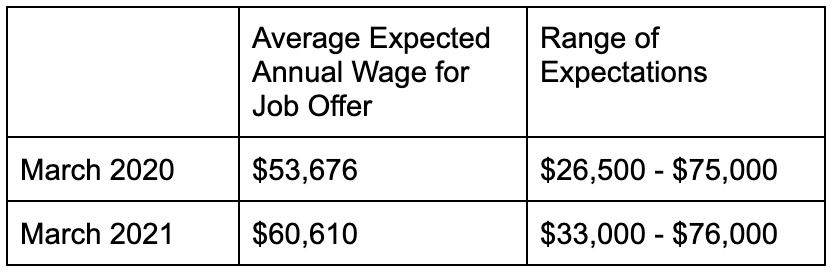

It’s also important for businesses to address the issue of rising wages. According to a survey of workers by the Federal Reserve Bank of New York, the average annual salary that US job seekers expect from job offers increased significantly over the past year. Expectations increased most dramatically on the lower end of the range, likely reflecting the expectations of hourly wage earners and those seeking entry level jobs:

With the Consumer Price Index also rising sharply in key categories such as food, gasoline, automobiles, and housing, some economists predict inflation may become persistent and self-fulfilling. Rochester economist Narayana Kocherlakota says, “If businesses and workers assume an inflation rate of greater than two percent when making wage determinations for the coming fiscal year, it can start to become self-fulfilling; workers will have to be paid more and, because of that, prices will have to go up.”

It can prove difficult to attract and retain talent in this type of economy, but the overall consensus is that businesses will have to meet pay raise expectations of up to 4% by 2023. Other strategies to win the war for talent include:

-

Phasing in hourly wage raises, “with $1 to $2 increases every three to six months as a retention tool.” Instead of bumping up wages a lot in a single raise, spreading them out helps businesses pace inflation pressure without getting ahead of it. If the economy changes or the Fed takes action to abate inflation, businesses can pause increases and hold hourly wages in place.

-

Offering bonuses – sign-on bonuses to attract new workers and retention bonuses to keep valued, high-performing employees.

-

Including salary ranges in job postings – a recent study found that about 12 percent of job postings across all occupations offered wage information compared to just 8 percent last year.

-

Being creative – one restaurant created a “tip the kitchen” program so that gratuity could be given to back-of-the-house staff like line cooks and dishwashers. The program has increased their wages to an average of almost $24 an hour. This also served to increase the number of job applicants, so the business was able to bring staff levels up from about 50-60% to 100% in about three weeks.

The ongoing minimum wage rate hike battle

Though many businesses have found recent success filling open positions when boosting their hourly wage to $15 an hour, there are also many skeptics. Many lawmakers do not believe now is the right time to institute a federal, nationwide minimum wage mandate. Opponents of the $15 minimum wage fear increased operating costs will force job losses and business closures; supporters believe it will help by increasing consumer spending and lowering employee turnover.

It’s also worth noting that one unintended consequence of raising the minimum wage is that it would in turn raise the cost of child care by about 21%. According to a study by the Heritage Foundation, that would add an extra $3,728 per year for a family with two children.

Ensuring growth

As a business leader, it’s important to stay abreast of employment issues and trends. Whether your business is planning to expand hiring or simply fill existing job openings, it is critical to understand how current economic conditions and government benefits programs affect your workforce so you can beef up recruitment efforts and be prepared to attract talent amid a labor shortage.

Businesses need to grow and that means you need human capital that can get you to the next level while allocating your financial capital on growth. Asure can help. Asure builds HCM software and services that help companies attract, develop, and retain great people and deliver it in a way that aligns with your financial goals.