Managing finances and maintaining healthy cash flow are perennial challenges for small business owners. In an economic landscape marked by uncertainty and fluctuating market conditions, small businesses often find themselves navigating tight financial constraints. Operational pressures, such as rising costs, supply chain disruptions, and labor shortages, further complicate the financial picture. Unlike larger enterprises with greater financial reserves and access to capital, small businesses must strategically manage every dollar to sustain operations, invest in growth, and weather economic downturns.

This blog explores small business finances and cash flow management, offering insights and strategies to help small business owners thrive despite the financial pressures they face. At its heart, cash flow for business owners is all about tracking the amount of money coming in and out of an organization. It allows you to get an overview of all of your expenses and revenue so that you can always have enough money to pay your bills. Other than learning the answer to, “What is cash flow?”, you should find out how to calculate and interpret the cash flow formula.

What Is Cash Flow?

What is cash flow? More importantly, how can it help your business?

The basic cash flow definition is that cash flow is the net cash that goes in and out of your business. Your company’s cash flow may be earned from its operations, financing, or investing. You can use your cash flow to assess your organization’s liquidity and financial performance. For example, an illiquid company will struggle to cover unexpected expenses, like repair costs or necessary capital expenditures.

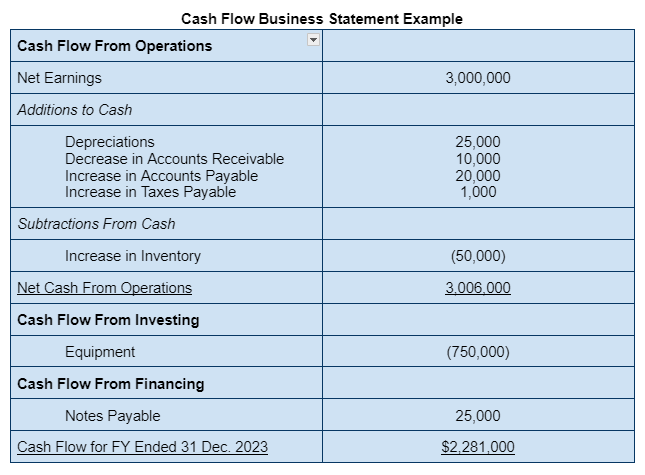

Typically, your cash flow formula will be written out on a cash flow business statement. The following is an example of what your cash flow statement might look like.

The Cash Flow Formula

At its most basic level, the cash flow formula is made by simply subtracting your monthly outflows from your monthly inflows. As your small business becomes more complex, the working cash flow definition and formula you use will naturally change. For example, a more complex cash flow formula would look like the following example.

Net Cash Flow = Operating Cash Flow + (Net) Financing Cash Flow + (Net) Investing Cash Flow

Meanwhile, the following three formulas can be used to create your operating cash flow, financing cash flow, and investing cash flow. Once these figures are created, you can plug them back into the cash flow formula that is listed above.

Operating Cash Flow = Net Income + Non-Cash Expenses – Changes to Your Working Capital

Financing Cash Flow = Cash Inflows From Issuing Debt or Equity – (Dividends Paid + Debt and Equity Repurchases)

Investing Cash Flow = Purchase or Sale of Equipment and Property + Purchase or Sale of Other Companies + Purchase or Sale of Marketable Securities

10 Tips for Managing Small Business Finances and Cash Flow

In order for your company to succeed, it needs to build a positive cash flow. Through the following tips for managing small business finances and cash flow, you can get a headstart on reaching your financial goals.

1. Invoice Quickly

Accounts receivable is the money your business is owed from its customers. When someone makes a purchase, you should send out an invoice as quickly as possible. While buyers may still be slow about making their payments, you can speed up the process by collecting your accounts receivable invoices as soon as the order has been delivered. You can also ensure timely payments by including payment timelines and terms on each invoice.

2. Choose Your Payroll Cycle Wisely

Retailers and fast food restaurants shouldn’t have an issue paying employees on a weekly basis because they have a consistent revenue stream coming in. If you run a warehouse, you may receive customer payments less frequently. To make your cash flow situation easier, you may want to pay employees on a bimonthly or monthly basis. Streamline the process with automated payroll software that saves time and ensures accuracy.

3. Understand Your Labor Efficiency Ratio

Your company’s labor efficiency ratio is made by dividing your company’s gross profit (minus your direct labor, benefits, and employer burden) by its direct labor cost. The resulting figure shows how much you spend for every labor dollar. To be a profitable company, each dollar you spend on labor should result in $2 of earnings.

4. Focus on Cash Flow Instead of Profits

For your business to be a success, you need to understand the cash flow definition and how it impacts your company’s viability. Without a good cash flow, you won’t have the liquidity you need to meet all of your obligations. While many businesses emphasize profits the most, your cash flow is really more important than profits for your long-term success. If you can’t pay your month-to-month bills, you won’t be able to keep your doors open.

5. Keep Monitoring Your Cash Flow

One of the most important tips for managing small business finances and cash flow is to keep monitoring any changes. Your cash flow will naturally vary from month to month. While most of these fluctuations are minor, you need to be aware of them so that you will know if your company has enough cash coming in to meet its ongoing obligations.

6. Lower Your Costs

After creating the cash flow statement for your business, take a look at your expenses and costs. Recurring expenses can add up over time, so it’s important to see if there are easy ways you can reduce some of your ongoing costs.

7. Invest in Accounting Software

You don’t have to create and monitor your cash flow business statements by hand. There are simple accounting software programs you can use to track your cash flow. In addition, this type of software can help with other small business issues.

8. Take Longer Amortization on Loans

If you expect a cash crunch in the near future, you may want to take a longer amortization schedule on your company’s loans. This allows you to make lower payments each month. If cash flow is a struggle, your business may need the added flexibility more than it needs to save money on interest rates.

9. Project Your Future Cash Flow

If you are using an accounting software program, you can project what your cash flow will look like in the future. This is especially important for organizations that have seasonal changes in their revenue. By projecting your future cash flow, you can navigate your busy and slow seasons in a way that will keep you financially comfortable throughout the year.

10. Delay Your Expenses

If you have negative cash flow, your first goal is to increase your revenue. Unfortunately, this isn’t always possible. Another way to improve your cash flow is by reducing or delaying your current expenses. For example, you may be able to refinance a loan or renegotiate payment terms with a vendor. If you can decrease your monthly expenses in the short term, your business may be able to survive long enough to get caught up.

Take Your Cash Flow Business Tips to the Next Level

After learning the basic answer to “What is cash flow?”, the next step is figuring out how the cash flow definition can help your business. By learning the best tips for managing small business finances and cash flow, you can improve your company’s liquidity, financial security, and flexibility.

Removing administrative burdens can help you focus on the business of your business. Connect with one of our small business payroll & HR experts today to get the support you need to focus on growth.