Was your business impacted by COVID?

The Employee Retention Tax Credit is the largest business tax credit in our country’s history. Unfortunately, most business owners don’t realize they qualify.

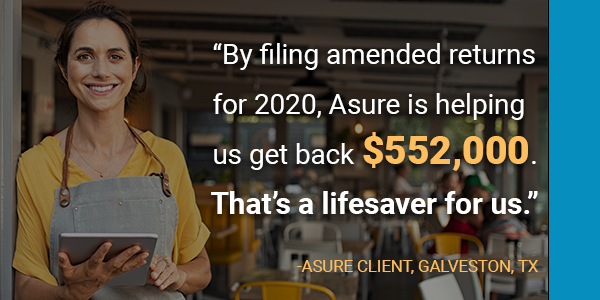

Asure has empowered our small business customers to claim more than $300 million in ERTC (and counting).

Let us help you claim your funds. Get started today!

ERTC Facts

The Employee Retention Tax Credit was introduced as part of the CARES Act and included tax credits for businesses to retain employees during the pandemic.

The ERTC is one of the single largest small business stimulus in US history.

Small businesses who claimed a PPP loan can still be eligible for ERC.

ERTC can be claimed retroactively and the window to file for credits is still open.

How Much Could You Qualify For?

2020 Credits

The 2020 CARES Act established an employee retention credit of 50% of $10,000/employee in qualified wages for eligible businesses or $5,000 tax credit per employee. Originally, businesses had a choice between PPP funds or ERTC credits, but not both. Then, on Dec. 27, 2020, the Consolidated Appropriations Act (CAA) modified the CARES Act so that businesses who received PPP loans can now retroactively also participate in ERTC so long as they don’t double-dip and apply for ERTC with payrolls paid with PPP funds. The window for claiming 2020 ERTC credits closed on April 15, 2024.

2021 Credits

The Consolidated Appropriations Act (CAA) passed on December 27, 2020 and extended the ERTC to Q1 and Q2 of 2021 with richer benefits and new eligibility requirements. Then, the American Rescue Plan Act (ARPA) was signed into law on March 11, 2021 and extended ERTC through Q3 and Q4 of 2021. Q4 was later eliminated by The Infrastructure Investment and Jobs Act signed into law on Nov. 15, 2021.

The 2021 credits total 70% of wages up to $10,000 per employee per quarter. The result is a credit up to $7,000 per employee for up to three quarters in 2021 totaling $21,000.

We’re getting a $689,000 tax credit. That’s exactly the help we needed to climb out of the downturn.

– Asure Client, Manufacturer in Skokie, Illinois

How can Asure help?

Asure’s employee self-service options let your team members view and update their personal details, access paystubs, and view W-2 information. The employee portal is accessible from mobile devices and desktop or laptop computers. Managers can use the portal to send announcements and alerts, as well as approve data changes and control which features are accessible via the employee portal.

Review Qualified Wages

With your payroll data, Asure will identify eligible wages – including qualified health plan expenses.

Calculate Credit Amount

Asure will calculate eligible ERTC wages – taking into consideration the dates of your PPP loan.

File Amended Returns

Asure will process the credits in our payroll system for audibility and file the necessary amended tax returns.