For 2016, the IRS is requiring that Forms W-2 and 1099-MISC be filed by January 31, 2017, which is a month earlier than in prior years. To meet this new deadline, all due dates leading up to it must also be earlier.

Savers Admin is committed to meeting this important deadline on behalf of our clients. We understand that tax time is a very confusing time of the year. To help alleviate the confusion and streamline the process, we’ve created a timeline for our clients. Closely adhering to this timeline will ensure that they are meeting the critical deadlines that allow them to remain in compliance with state and federal guidelines.

Savers Admin is committed to meeting this important deadline on behalf of our clients. We understand that tax time is a very confusing time of the year. To help alleviate the confusion and streamline the process, we’ve created a timeline for our clients. Closely adhering to this timeline will ensure that they are meeting the critical deadlines that allow them to remain in compliance with state and federal guidelines.

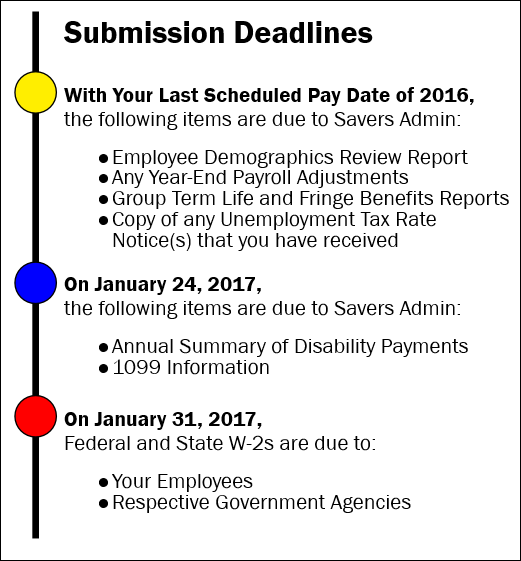

Due by last scheduled pay date of 2016

The following information will be due no later than your last scheduled pay date of the year:

- Employee Demographics Review– To ensure the accuracy of your 2016 W-2 forms, Savers Admin will send you an Employee Verification Report. This report lists all of your employees who received wages in 2016. It includes their full name, address and social security number. This report will be included with your payroll reports on your last pay date in November. Please be on the lookout for this report!

- Any Year End Adjustments—These adjustments include Group Term Life, Fringe benefits, additions for 2% Shareholders, personal use of company car and mileage/car/housing reimbursement or allowances etc. To determine whether a particular fringe benefit is taxable in your particular situation, please consult your tax advisor or accountant.

- Unemployment Tax Rate Notice Due—You will be receiving a notice from your state’s unemployment division that will provide you with your company’s 2017 unemployment tax rate. If you file in multiple states, please be sure to send copies of all notices you receive. If you have not received your notice(s) by December 12th, please contact us immediately so we can help obtain it.

Note: Some clients may also receive a 2017 Federal Tax Deposit Requirements notice from the Internal Revenue Service and/or a Notice of Change in Filing Frequency from your state(s) Department of Revenue. However, if your deposit schedule doesn’t change for 2017, they will not send you a new schedule. Please don’t be alarmed if you don’t receive a new deposit schedule.

To our payroll clients: If you receive a notice of ANY kind, it is vitally important that you send a copy of it to your Savers Admin payroll processor.

Due by January 24th, 2017

Annual Summary of Disability Payments—

Employers must report any taxable or non-taxable sick pay that employees receive from a third-party provider if that provider does not file a W-2 for the affected employee. This would include any payments made to an employee by an insurer or similar entity due to an injury or illness which resulted in the employee being unable to work.

1099 Information – The information needed to process 1099’s should be submitted no later than January 24th 2017.

Due by January 31st, 2017

New due date for Federal and State W2’s.

Please understand that additional fees will be charged for items received after their deadline.