Employees Using Asure PTM

Tax Liabilities Under Management

Industries Served

Stay Compliant and Focused on Growth

Never miss a deadline again. Asure’s standalone Payroll Tax Management software automatically schedules your payroll tax return deadlines, keeping track of all relevant tax dates. You’ll receive reminders and notifications, ensuring that all your tax obligations are met on time, every time.

Automated Scheduling

Never miss a deadline again. You’ll receive reminders and notifications, ensuring transparency that all your tax obligations are met on time, every time.

Streamlined Filing Process

Filing your payroll taxes has never been easier. Lean on our experts to file on your behalf or with e-filing capabilities, you can submit forms directly to tax authorities with just a few clicks, reducing paperwork and speeding up the process.

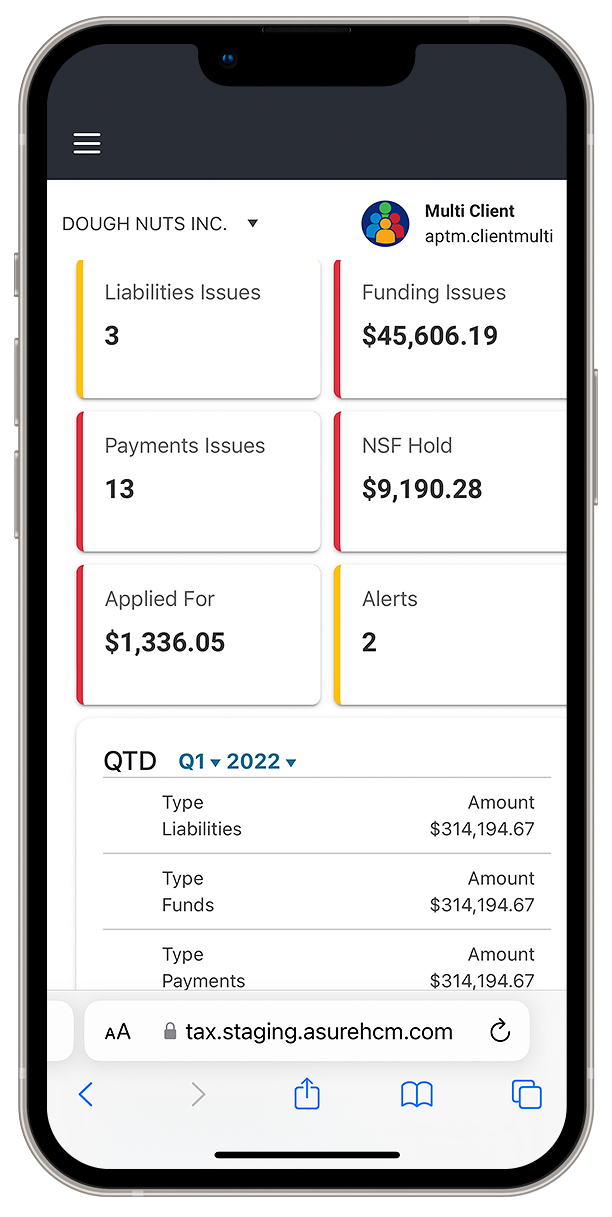

Real-Time Monitoring and Alerts

Stay informed with real-time monitoring of your filed returns. You’ll have complete visibility into your payroll tax filings, with detailed records readily available for audits or inquiries

The Asure Advantage

Specialized Expertise

Over 25 years of expertise. We specialize in multi-state entities and handle billions in annual liabilities, reducing your risk and making processes more efficient

Advanced Compliance

Stay ahead of changing laws and employment trends with our automated processing, notice and amendment tracking, and comprehensive dashboards

Reduce Risk

Improved accuracy reduces the risk of errors with automated form generation and filing, ensuring your tax returns are precise and compliant.

Flexible Delivery

Unlike other providers, we offer solutions from full-scale payroll tax filing to in-house management. Get what you need to match your requirements and budget